3.7.1 Indexation

3.7.1.1 Indexation of weekly payments | 3.7.1.2 Previous position earnings (PPE) | 3.7.1.3 Statutory maximums | 3.7.1.4 Indexation table| 3.7.1.5 Indexation to CPI |

The legislation provides for the indexation of weekly payments, medical and like services, employer excess, weekly pensions for dependants and certain other amounts.

3.7.1.1 Indexation of weekly payments

Unless a worker is receiving the statutory maximum of weekly payments, indexation occurs on the anniversary of the day on which the worker became entitled to weekly payments for their injury (s542 WIRC).

When indexation is applied, the worker’s weekly payment amounts are varied based on movement in Victorian average weekly earnings.

This movement is calculated using the average weekly total earnings of employees in Victoria in original terms published by the Australian Bureau of Statistics (ABS) as at:

-

the 15th day of the month preceding the month that indexation occurs; and

-

the 15th day of the corresponding month one year earlier.

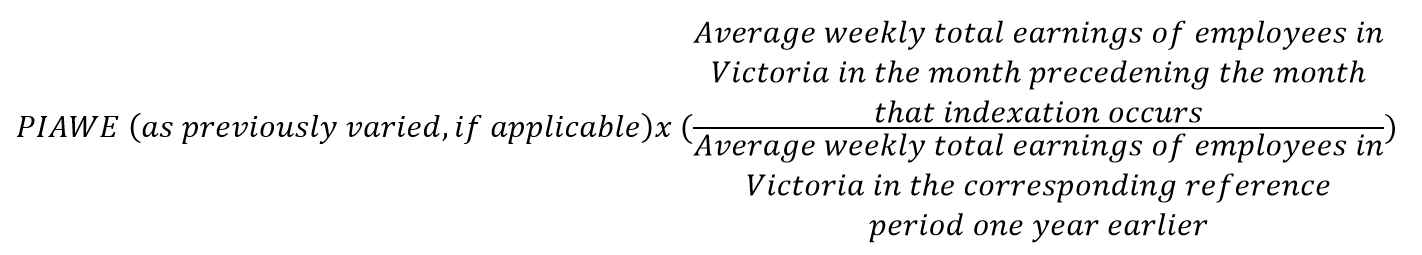

Indexed weekly payment amounts are calculated by varying the amount of a worker’s PIAWE in accordance with the following formula:

If PIAWE has previously been varied in accordance with the above formula, the varied PIAWE amount must be used when indexation next occurs, subject to s542 WIRC Act Workplace Injury Rehabilitation & Compensation Act 2013.

Note: From August 2012, the ABS publishes AWE Average Weekly Earnings figures six-monthly, in February and August of each year. Prior to this date, quarterly figures were published.

Negative indexation

If the indexation factor calculated in accordance with the above formula is negative and would result in a reduction of a worker’s PIAWE, indexation does not take effect and the worker’s weekly payments stay the same.

When indexation next occurs, the previous negative percentage amount is offset against any positive movement in the indexed amount. The PIAWE will not increase until all the reduction has been offset even if this takes more than one year.

| Year 1 | Year 2 |

|---|---|

|

PIAWE pre-indexation = $1,000 Indexation factor = -1.25% Worker’s PIAWE and weekly payments remain the same and the worker’s PIAWE does not reduce despite the reduction in Victorian average weekly earnings. PIAWE post-indexation = $1,000 |

PIAWE pre-indexation = $1,000 Indexation factor = 3.25% Offset from previous negative indexation = -1.25% Net indexation factor = 2.00% PIAWE post-indexation = $1,000 x 102% = $1,020 The worker’s PIAWE is indexed by 2%, which is the current indexation factor of 3.25% as offset by the -1.25% previous indexation factor. |

| Claims with indexation dates 1 October – 31 March | ||

|---|---|---|

| INDEXATION YEAR 1: Claim indexes in period 1 October 2021 - 31 March 2022 | INDEXATION YEAR 2: Claim indexes in period 1 October 2022 - 31 March 2023 | INDEXATION YEAR 3: Claim indexes in period 1 October 2023 - 31 March 2024 |

|

PIAWE pre-indexation = $1,000 Indexation factor = -2.7158% Worker’s PIAWE does not reduce despite the reduction in Victorian average weekly earnings. PIAWE post-indexation = $1,000 |

PIAWE pre-indexation = $1,000 Indexation factor = 2.7123% Offset from previous negative indexation = -2.7158% Net indexation factor = -0.0035% PIAWE post-indexation = $1,000 Worker’s PIAWE does not reduce despite the negative indexation factor. |

PIAWE pre-indexation = $1,000 Indexation factor = 3.1071% Offset from previous negative indexation factor = -0.0035% Net indexation factor = 3.1036% PIAWE post-indexation = $1,031.04 |

Indexation - rounding

Under the legislation, where the indexed weekly payment amount is:

-

less than $1,000, the indexed figure can be rounded to the nearest whole $1

-

greater or equal to $1,000, the indexed figure can be rounded to the nearest $10

Indexation for workers with entitlements before 5 March 1990

For workers who became entitled to weekly payments before 5 March 1990, PIAWE is indexed on 1 July, as this is the date that is deemed to be the anniversary of the injury.

3.7.1.2 Previous position earnings (PPE)

Previous position earnings (referred to as notional earnings in ACCtion) are the ordinary time earnings (i.e. ordinary earnings without earnings enhancements) the worker would now be earning in the same position/s had no injury occurred. PPE relate to the same position/s that the PIAWE calculation was based on.

PPE act as a benchmark for indexed PIAWE to ensure that indexed PIAWE do not exceed PPE. This is because weekly payments are intended to replace but not exceed income, subject to statutory rates (95% and 80%).

As such, where indexation of PIAWE produces a dollar value that exceeds PPE, the indexation is disallowed. Instead, PPE are accepted as PIAWE in place of the indexed amount.

The Agent should seek PPE from the injury employer prior to the weekly payments anniversary. It is also open to the Agent to determine PPE by reference to any relevant Award rates that apply to the worker.

Where PPE cannot be ascertained, PIAWE indexation will apply without any regard to PPE.

How PPE affect PIAWE:

-

Where PPE are less than the PIAWE before indexation, indexation does not apply and PIAWE does not increase. This may occur in the following scenarios:

-

Where at the date of indexation the week count on a claim is less than 52 weeks. Refer to example 2a below.

-

Where the employer has not provided PPE for a period of time. Refer to example 2b below.

-

-

Where PPE are greater than the PIAWE before indexation but less than the PIAWE after indexation, then the PPE are accepted as PIAWE instead of indexation (example 3 below)

-

Where PPE are greater than the PIAWE after indexation, then indexation applies (example 4 below)

-

Where PPE are not provided/available (e.g. employer has ceased trading and there is no award governing pay rates for the worker ) indexation applies (example 1 below)

Examples of how PPE affect PIAWE

| Indexation date | PIAWE before indexation | % used | PIAWE after indexation | Notional earnings (PPE) | Resultant PIAWE |

|---|---|---|---|---|---|

| 05/07/2020 |

1798 |

3.1662 |

1850 |

1850 |

$1798 x 1.031662 = $1854.9282 (rounded to $1850 being nearest $10)

Max payable amount = $1850 x 80% = $1,480.00.

Example 2a – PPE is less than PIAWE before indexation because PIAWE includes earnings enhancements

In this example, on the date of indexation, the week count on the claim is less than 52 weeks (as the worker has had weeks during the first year of the claim where compensation was not payable), and the PIAWE being indexed includes earnings enhancements. The PIAWE before indexation of $2070 exceeds the PPE of $1600 (which is the ordinary earnings current equivalent without enhancements). Therefore, indexation will not be applied at that time.

| Indexation date | PIAWE before indexation | % used | PIAWE after indexation | PPE (Notional earnings) | Resultant PIAWE | |

|---|---|---|---|---|---|---|

| Claim indexed without PPE | 05/07/2020 |

2070 ($1500 base rate + $570 overtime) |

3.1662 | 2140 | 2140 | |

| PPE entered | 05/07/2020 | 2070 | 3.1662 | 2136* | 1600 | 2070 |

|

Indexation occurs Earnings enhancements drop off |

06/09/2020 (week count = 52 weeks) |

1500 | 3.1662 | 1547 | 1600 | 1550 |

*$2070 x 1.031662 = $2135.5403 (rounded to $2140 being nearest $10 if no PPE, or rounded to $2136 nearest $1 if PPE provided).

As previous position earnings are less than the PIAWE before indexation, indexation does not apply and PIAWE does not increase.

Max payable amount for a worker during the second entitlement period would be $2070 x 80% = $1,656.

However, when earnings enhancements drop off (i.e. after 52 weeks), indexation is recalculated by comparing PPE ($1600) to indexed PIAWE ($1550). In this example, the worker receives the full benefit of indexation, being $1550.

Note: the “Resultant PIAWE” figures are rounded to the nearest $10.

Example 2b – PPE is less than PIAWE before indexation because employer hadn’t provided PPE for a number of years

| Indexation date | PIAWE before indexation | % used | PIAWE after indexation | PPE (Notional earnings) | Resultant PIAWE | |

|---|---|---|---|---|---|---|

| Claim indexed without PPE yr1 | 05/07/2020 |

2070 |

3.1662 | 2140 | No PPE provided | 2140 |

| Claim indexed without PPE yr2 | 05/07/2021 | 2140 | 4.4774 | 2240 | No PPE provided | 2240 |

| Claim indexed without PPE yr3 | 05/07/2022 | 2240 | 0.8805 | 2260 | No PPE provided | 2260 |

| PPE entered yr3 | 05/07/2022 | 2240 | 0.8805 | 2260 | 2230 | 2240 |

Here the employer in year 3 has indicated that the PPE for year 3 are $2230. Consequently indexation does not apply and the PIAWE for the year commencing 05/07/2022 remains at the PIAWE prior to indexation of $2240.

Note: In this example we have assumed the PIAWE does not include earnings enhancements.

| Indexation date | PIAWE before indexation | % used | PIAWE after indexation | PPE (Notional earnings) | Resultant PIAWE | |

|---|---|---|---|---|---|---|

| Claim indexed without PPE | 05/07/2020 |

1778 (base rate, no earnings enhancements) |

3.1662 | 1830 | 1830 | |

| PPE entered | 05/07/2020 | 1778 | 3.1662 | 1834* | 1800 | 1800 |

*$1778 x 1.031662 = $1834.2950 (rounded to $1830 being nearest $10 if no PPE, or to $1834 nearest $1 if PPE provided).

Where PPE are greater than the PIAWE before indexation but less than the PIAWE after indexation, then the PPE are accepted as PIAWE instead of indexation. This is because the PPE act to limit the PIAWE that the worker is entitled to post indexation, in accordance with s 542(2).

Max payable amount = $1800 x 80% = $1,440.

| Indexation date | PIAWE before indexation | % used | PIAWE after indexation | PPE (Notional earnings) | Resultant PIAWE | |

|---|---|---|---|---|---|---|

| Claim indexed without PPE | 05/07/2020 |

2630 (base rate, no earnings enhancements) |

3.1662 | 2710 | 2710 | |

| PPE entered | 05/07/2020 | 2630 | 3.1662 | 2710 | 2720 | 2710 |

$2630 x 1.031662 = $2713.2710 (rounded to $2710 being nearest $10).

Where PPE are greater than the PIAWE post-indexation, indexation applies. The worker receives the full benefit of indexation - PPE do not act to limit the indexed PIAWE.

Max payable amount = $2710 x 80% = $2,168.

Note: In above examples, the claim is considered to be post 13 weeks paid/payable.

Note: An increase in the PPE that took effect after the effective date of indexation of PIAWE cannot be used until the next indexation of PIAWE. However, any increase that took effect before the date of indexation will require a recalculation of the indexed PIAWE.

3.7.1.3 Statutory maximums

The statutory maximums payable for weekly payments for claims for weekly payments first made on or after 5 April 2010 are varied on 1 July each year and:

-

equates to twice the State average weekly earnings (s161, 162 WIRC Act)

Note: State average weekly earnings are recalculated on 1 July each year based on the average weekly earnings of employees in Victoria in original terms as published by the ABS as at June in the preceding financial year -

remain constant throughout the financial year. This may mean that the statutory maximum amount is different across claims depending on the date that the entitlement to weekly payments commenced if there has been a reduction in the average weekly earnings over the last 12 months

If, after an increase in average weekly earnings in Victoria, a worker is no longer receiving the statutory maximum amount, the claim will instead be indexed on the anniversary of the worker’s incapacity for work.

Scenario

- Claim lodged on 8 August 2013

- PIAWE is $4,500 per week

- worker has no current work capacity Under the legislation, unless inconsistent with the context or subject-matter — current work capacity, in relation to a worker, means a present inability arising from an injury such that the worker is not able to return to his or her pre-injury employment but is able to return to work in suitable employment, declared training program

- statutory maximum (twice State average weekly earnings) is $2,050

- from 1 July 2014 the statutory maximum payment rate increases to $2,130

Result

80% of $4,500 ($3,600) is greater than the current maximum benefit of $2,130 and therefore payments are limited to $2,130.

From 1 July 2014 the amount is recalculated to take into effect the maximum benefit rate increase. Therefore, even though 80% PIAWE remains at $3,600 the maximum weekly payment has risen and the worker’s entitlement is increased to $2,130 per week, which is the maximum.