3.8.1.1 Process for non-entitlement

The employer or worker advises the Agent that the worker has received a superannuation or termination lump sum.

3.8.1.2 Determine the non-entitlement period

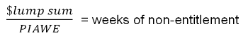

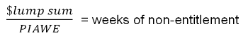

To determine the period of non-entitlement to weekly payments divide the lump sum amount by the worker’s PIAWE indexed.

If the period of non-entitlement extends beyond when the next indexation of PIAWE occurs, recalculate the period of non-entitlement using the indexed PIAWE.

The period of non-entitlement may have to be calculated more than once depending on whether the period of non-entitlement extends beyond the date on which the next indexation of PIAWE occurs.

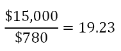

Example 1

Assume that:

- PIAWE indexed is $780

- lump sum amount is $15,000

- lump sum received on 14 March 2013

- the worker was injured and ceased work on 10 November 2012

The calculation is:

In the example this is:

Note: The period of non-entitlement is rounded to 19 weeks.

In this example the period of non-entitlement ends before the next indexation of PIAWE due on 10 November.

See: Process for non-entitlement

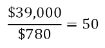

Example 2

Assume that:

- PIAWE indexed is $780

- lump sum amount is $39,000

- lump sum was received on 14 March 2013

- the worker was injured and ceased work on 10 November 2012

The calculation is:

In the example this is:

The period of non-entitlement of 50 weeks starting from 14 March 2013 will extend beyond the date on which the next indexation of PIAWE occurs (10 November 2013).

The length of the period of non-entitlement before next indexation in this example is 34 weeks and three days.

The non-entitlement period must be recalculated once PIAWE is indexed on 10 November. The recalculation must be deducted from the lump sum, the value of the lump sum already used in calculating the non-entitlement period up to the indexation date.

In this example the estimated value of compensation for the period 14 March 2013 up to 10 November 2013 is ($780x34 + $780x3/5) $26,988 (34 weeks and three days).

The balance of lump sum to be used to calculate the balance of the period non-entitlement post indexation is ($39,000 - $26,988) $12,012.

The formula below to calculate the balance of the period of non-entitlement post indexation with the new indexed PIAWE.

This process is repeated if the revised end date of the period of non-entitlement extends beyond a further indexation date.