3.1.4 Categories of workers

3.1.4.1 More than one employer | 3.1.4.2 Contractors, capital & materials | 3.1.4.3 Owner drivers | 3.1.4.4 Entitlements for self-employed persons | 3.1.4.5 Students | 3.1.4.6 Seasonal or itinerant workers | 3.1.4.7 Workers who receive piece rates | 3.1.4.8 Deemed full-time worker | 3.1.4.9 Miscellaneous employees | 3.1.4.10 Share farmers

Agents must take into consideration the information contained in this section to calculate PIAWE for any of the following categories of workers.

3.1.4.1 More than one employer

If a worker is employed by two or more employers at the time of injury, the worker’s capacity for all employers at the time of the injury must be taken into consideration before determining the applicable Item in Schedule 2.

More than one employer but not incapacitated for work with all employers

If the worker works for more than one employer and sustains an injury that results in an incapacity for work with one or more of those employers but not for all employers, the worker’s pre-injury average weekly earnings PIAWE are to be calculated using earnings from work with all employers.

More than one employer & incapacitated for work with all employers (Schedule 2, Items 2 to 6)

Normal hours

If the worker has more than one job and works for one employer for:

- at least the normal hours fixed in the industrial award or

- 38 hours per week if there is no applicable industrial award

the PIAWE calculation is based on that job.

Normal hours spread over multiple employers

If a worker works for multiple employers, and the total hours worked is equivalent to a full-time worker, PIAWE is calculated by using the job with the higher base rate of pay.

Less than full time hours

If the worker works for less than 38 hours over both employers, an average of the ordinary rate of pay from all jobs must be multiplied by the total number of hours per week.

Earnings can only be included in PIAWE if there is an employment relationship between the employer and the injured worker. If no employment relationship exists, the earnings must be excluded.

An example of earnings that may not be considered to be from an employee-employer relationship is ride share drivers (e.g. Uber) or food delivery drivers.

Agents and Self-insurers should review and request the below information to consider if there is an employment relationship:

-

Whether there is a contract of service. A contract of service is ordinarily needed to meet the definition of a ‘worker’.

-

Whether the worker provides all equipment, tools and other materials at their own cost.

-

Whether the worker maintain their own vehicle and workers’ compensation insurance.

Note: This advice does not apply to Current Weekly Earnings (CWE Current Weekly Earnings). The Act defines CWE separately from PIAWE. All sources of earnings are expected to be included in CWE.

See: 3.5.3 Current Weekly Earnings – Calculate CWE for Self Employment

Higher base rate of pay

Calculate PIAWE from the job with the higher base rate of pay if the worker has more than one employer and works:

- the normal hours fixed by the award or

- 38 hours per week if no applicable industrial award.

Use the job with the higher base rate of pay if the worker:

- works the normal hours at more than one job, for example, if the worker has two jobs and works normal hours in both of them, use the job with the highest ordinary rate

- works with one employer for the normal hours and with another for at least 38 hours per week, for example, if the worker works the normal hours in one job and 38 hours in another, use the job with the highest ordinary rate

- works for more than one employer for at least 38 hours if there is no applicable industrial award, for example, if the worker works 38 hours in two jobs, use the job with the highest ordinary rate

More than one employer - less than normal hours

There is a separate calculation if the worker has more than one employer and works less than:

- the hours fixed in an industrial award or

- 38 hours per week.

To calculate the PIAWE:

- average the ordinary rates of pay from all jobs

- multiply that average by the lowest number of hours of, either:

- the normal hours per week or

- 38 hours per week.

Relevant period for a worker with more than one employer

If the worker has worked with multiple employers during the relevant period however has not worked at all employers for the whole 52 week period, and items 2 to 7 in Schedule 2 do not apply, the period of concurrent employment would be utilised for the assessment of PIAWE.

Calculate employer threshold period if more than one employer is involved

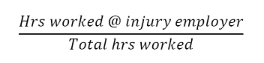

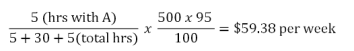

Employers are liable to pay the first 10 days of weekly payments as part of their excess (unless the employer has taken a buy-out option or the worker is entitled to provisional payments). Where more than one employer is involved, the liable employer pays a proportion of the first 10 days based on the number of hours worked per week with the liable employer divided by the total hours worked by the worker for all employers.

- worker was injured whilst employed with Employer A

- worker's hours are:

Employer A – 5 hours

Employer B – 30 hours

Employer C – 5 hours - PIAWE is $500

The weekly payment amount for the first 13 weeks for a worker with no current work capacity Under the legislation, unless inconsistent with the context or subject-matter — current work capacity, in relation to a worker, means a present inability arising from an injury such that the worker is not able to return to his or her pre-injury employment but is able to return to work in suitable employment, declared training program (CWC Current Work Capacity) and no weekly earnings (CWE) is 95% of $500 = $475

The amount of weekly payments to be paid by Employer A for the first 10 days is:

$475.00 - $59.38 = $415.62

The Agent pays $415.62 per week for the first two weeks (10 days) and then pays $475.00 per week up to 13 weeks assuming the worker continues to have NCWC No Current Work Capacity, in relation to a worker, means a present inability arising from an injury such that the worker is not able to return to work, either in the worker's pre-injury employment or in suitable employment.

See: Timeframes to forward claims | Claims with multiple employers